Through Intimidation of citizens, they demand outdated debts of “Singergija” and “Prizma”

Povezani članci

- Nevesinje – Tender for transfer from municipal to private pockets

- The European Anti-Fraud Office is investigating Elmedin Voloder and Autoceste FBiH!

- Construction of the Banja Luka-Prijedor Highway: Contract drafted in favour of Chinese investors, violates state aid rules

- Gacko: Will forging sick leave go unpunished?

- RS and Serb nationalists on the verge to let the BiH and Western Balkan powder keg explode – risking a next Balkan war

- RUGIP renounced the practice of favouring lawyers

Everything that the Sarajevo branch of the debt collection agency “Eos Matrix” demands from thousands of citizens, many of whom were fraudulently involved in loans from several microcredit companies, has become obsolete after five years, the Supreme Court of Republika Srpska confirmed.

By: Andrijana Pisarević/Cover photo: Illustration (Pixaby)

Thus, the mentioned court put an end to the decades-long problems of thousands of citizens and indirectly characterized certain actions of the mentioned company as illegal.

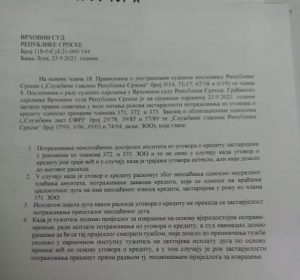

Without mentioning the names of microcredit organizations and banks, ie, addressing both, the Supreme Court took the position that claims for unpaid annuities (instalments) from the loan agreement become obsolete, not only while the contract is still valid, but also when the deadline has expired and there was no contract termination. That deadline is five years for uninterrupted contracts, and ten for those that are terminated. This is unequivocally confirmed by the documentation in the possession of our editorial office.

“In the event that the loan agreement is terminated due to non-payment and irregular payment of the instalment, the creditor’s claim, which refers to the entire repayment of the debt on behalf of the unpaid loan amount, becomes obsolete within ten years. The payment of a part of the debt after the termination of the loan agreement does not terminate the statute of limitations on the claims of the remaining unpaid debt. When the plaintiff filed a motion for enforcement on the basis of an authentic instrument (bill of exchange) for the payment of credit agreement claims, and the court subsequently ruled that the motion would be considered a lawsuit, the lawsuit was not modified if the plaintiff did not demand payment of the debt on the basis of a bill of exchange, but on the basis of a loan agreement, and in that case, the statute of limitations of the claim was interrupted by the first action, ie by submitting a proposal for execution”, stated the mentioned court.

“In the event that the loan agreement is terminated due to non-payment and irregular payment of the instalment, the creditor’s claim, which refers to the entire repayment of the debt on behalf of the unpaid loan amount, becomes obsolete within ten years. The payment of a part of the debt after the termination of the loan agreement does not terminate the statute of limitations on the claims of the remaining unpaid debt. When the plaintiff filed a motion for enforcement on the basis of an authentic instrument (bill of exchange) for the payment of credit agreement claims, and the court subsequently ruled that the motion would be considered a lawsuit, the lawsuit was not modified if the plaintiff did not demand payment of the debt on the basis of a bill of exchange, but on the basis of a loan agreement, and in that case, the statute of limitations of the claim was interrupted by the first action, ie by submitting a proposal for execution”, stated the mentioned court.

Ignored the court

However, this did not affect the policy of the company “Eos matrix”, which continues to file lawsuits, summon, intimidate and put pressure on “Prizma” alleged debtors, and now they have expanded the scope to a large number of citizens who are from the Microcredit Society “Sinergija Plus” raised loans in the period from 2001 to 2008, which went bankrupt in 2012. From then until today, all deadlines for lawsuits have expired, but that has not demoralized the “Eos Matrix” whose workers continue to call and pressure citizens to pay debts they did not even know about or that have become obsolete, which was confirmed by a large number damaged citizens.

As citizens who have been fighting lawsuits and, as they say, “persecutions” of employees from the “Eos Matrix” told eTrafika, almost all of them were victims from the first day when they were persuaded to raise unrealistically high amounts, and then they facilitated repayment, through various “reprograms”, in which they did not sign anything, indebted them even more and stuck them with interest that they were not even aware of.

Such a case happened to MS from the area of Doboj, who, out of fear of retaliation, asked us not to give her name. She said that she got a five-year loan in the amount of 24,000 KM in “Sinergija”, that she repaid it for more than three years, and that now the claim of “Eos matrix” from her is close to 60,000 KM.

“My intention was to get 15,000 KM, but the worker persuaded me to increase the amount to 24,000 KM. I don’t even know how I agreed to it, he was very convincing. I didn’t have another guarantor, and they took care of that. They stated that the loan was for the purchase of land, which is not true, because I did not buy it. My instalment was about 500 KM. I paid regularly for three years, I paid them about 20,000 KM in instalments, and then I got into financial trouble. I tried to agree with them to pay the instalments in two parts in one month, in order to make it easier for myself, but also to fulfil my obligations. They then proposed a reprogram to me “, says our interlocutor.

She admits that at that moment she did not even know what the word reprogram meant.

“They took me thirsty across water and convinced me and my father that he take off part of the funds, more precisely 3,000 KM of that loan, ‘onto himself’. We didn’t even understand what that meant and he suddenly owed them so much money without seeing so much as a single KM from it. Then they persuaded him again to take a 7,500 KM loan without any payment, in order to allegedly reduce the loan for me. Neither he got the money, nor did they reduce my credit. We addressed them and asked to clarify, it was not clear to us how they gave such a loan to an 85-year-old man and even persuaded him to do so. It was not a loan, but a reprogram. We never received any paper for the reprogram, in the end, it turned out that these were new loans”, she explained, recounting the deception to which they were exposed.

“They call us every day”

Our interlocutor says that according to their records, she and her father took out four loans of 24,000 KM, 3,000 KM, 15,000 KM and 7,500 KM.

“Everything came out close to 60,000 KM. I have all the bills and evidence. Then the ‘Eos matrix’ added some more interest to us, so that for the raised 24,000 KM that I initially took and repaid, this company asks me for close to 60,000 KM. It killed my father. My husband ended up in the hospital twice, I have health problems. God willing this is resolved without sacrificing our lives. And to my cousin who was a guarantor, his wife died of shock. There is allegedly a loan of 15,000 KM, for which they are now asking for 33,000 with interest, and for the one of 7,500 KM, they are asking for 22,000 KM. It is impossible to report and understand what they did and how they came to those amounts,” she points out.

She adds that she does not know “what kind of country we live in when something like this is possible”.

“To allow fraudsters to shut down entire families. I am so disappointed in this powerless country. This is such a well-coordinated mafia. If you were to see how they work, someone else calls you every time, they have countless phone numbers. Everyone has their own story. There are so many people cheated by ‘Sinergija plus’ in my environment. I would like people to move and say out loud that they are their victims, to sue them and to expose them. I know so many people who have suffered from them in the same or similar way. They are ashamed, we are all ashamed of how we were deceived,” she says.

She told us that the workers of “Eos” have been calling her every day for five years, putting pressure on her to pay fictitious debts. They threaten to confiscate their house and other property.

“If only you could hear how they address people and what they say. We did not receive any ban or blockade on salaries, but we decided to go against them. Our experience shows that you can never get out of their loans. I have never run away from my obligations and debts, but these are not my debts. We are blocked, they took everything away from us, we don’t have creditworthiness, we can’t get a loan worth 10 KM from banks,” she said.

A Banja Luka man who also insisted on anonymity recounts an almost identical experience.

“I admit, I’m ignorant. My daughter needed a computer for school and I ran into the then ‘Prizma’ and raised 2,000 KM. I am disabled, I do not have a permanent job, I live from casual jobs. So I repaid part, half of the amount, and came to the situation that I can’t repay the other until I find a new job”, he says.

Our interlocutor adds that a pure fraud on the part of the employees followed, but which, unfortunately, he did not understand at that moment.

“Later, when I got into trouble, people explained to me the fraud I was exposed to. If I hadn’t paid them a single KM, the interest could have reached the amount of the principal, and that debt of 4,000 KM or 2,000 KM, having in mind that I paid half of it, would have waited for collection. But they deceived me, persuaded me to make a reprogram and close that debt for principal and interest and to take out a loan of 4,000 marks again, close the debts and get on time, because that would be a new loan. Of course, then the principal becomes four, which goes to 8,000 KM with interest. Then they repeated the same story, to close the debts with a new loan of eight thousand, and then everything went to 16,000 KMwith interest. They deceived me, convinced me that it was better that way, later the people who tried to help me told me that it was illegal what they were doing. I admit, I owe them a thousand marks because I raised two and returned a thousand. They are asking for 15 thousand KM, I have not seen that money”, he explains.

Court proceedings

Slavica Popadić from Laktaši defeated “Eos matrix” in court and proved that she was deceived. However, the harassment of “Eos” after the victory did not stop because they called her because of another alleged debtor, who does not have a phone, forcing her to pressure them on their behalf. Because of all this, Slavica says, she had serious health problems, which is why she is considering suing this company again, this time for persecution and harassment.

In 2008, 14 years ago, she took out a loan with three friends at the Microcredit Foundation “Prizma”. All of them raised 4,000 KM each and were each others guarantors. Her debt increased from this amount to an incredible 14,800 KM in a short time.

“Unfortunately, a month later, a friend died. The very next day, they called me from ‘Prizma’ and transferred her complete loan to me. I told them I couldn’t handle it financially, but they did it anyway. Then they came from Sarajevo and pressured me to sign something. Then suddenly another 2,000 KM of burden appeared on my loan. Suddenly, with a 4,000 KM loan, I owed 10,000 KM. When I said that I would not pay for it and that I had never received that much money, they offered me a grace period of one year. However, I did not receive an explanation for this increase in debt, and they stopped responding. I repaid the instalments for a while, and then I lost my job and found myself in trouble. At the same time, this company went bankrupt and no one responded anymore. After a full 13 years, the ‘Eos matrix’ appeared with my alleged debt of 14,800 KM, because the interest, according to their calculation, reached the amount of 4,800 KM. I fainted from the shock and ended up in the hospital “, Slavica told eTrafika.

She says that this was the beginning of the terror she is experiencing from the workers of this company, due to which her health is seriously endangered.

“I can’t explain to you what they are doing to me. I had a nervous breakdown due to their harassment and persecution. Then I sued them and they lost. They called me until the last minute, until the verdict. Now we are waiting to see what will happen to another friend of mine who also sued them. It is interesting that she does not have a phone and they keep calling me because of her. I blocked at least 50 of their numbers. I heard that a lot of them reported it to the police, and I’m thinking of doing that and suing them for everything they did,” she said.

It doesn’t take much to understand that all “Sinergija’s” loans were created more than 10 years ago and are mostly obsolete, and that this microcredit organization has no basis for lawsuits, and especially not for harassing citizens who exceeded every measure, believes Din Tešić, a Banja Luka lawyer, who represents several hundred citizens who are fighting, as he says, the terror of “Prizma” and “Sinergija”.

“Before the courts in Republika Srpska, there was a controversial legal issue related to the application of Articles 372 and 373 of the Law on Obligations of Republika Srpska, which determined the statute of limitations for annuities and the right to claim from a loan agreement. In their decisions, numerous judges determined that it was a ten-year statute of limitations in question, and not three-year and five-year, as we claimed. Thus, the substantive law was incorrectly applied, which is why we appealed to the Supreme Court of Republika Srpska to initiate a procedure for resolving the disputed legal issue. The Supreme Court of Republika Srpska has clearly taken the legal understanding that Articles 372 and 373 of the Law on Obligations must be applied and that these are outdated obligations by which the ‘Eos Matrix’ demands sums of money from our clients,” says our interlocutor.

He adds that this legal understanding taken by the Supreme Court of Republika Srpska is binding in all other cases related to loan agreements when it is not terminated.

“And that was happening, as far as we are aware, with the MF company ‘Sinergija plus’ Ltd. Banja Luka, against which we have a certain number of cases in preparation, but also with certain banks. Finally, the court practice regarding claims under the loan agreement is being harmonized, which is a positive step towards exercising the rights of all citizens of Republika Srpska. With this legal understanding and new evidence related to the statements of former employees of MF ‘Prizma’, we believe that in already adjudicated cases there is a basis for a retrial,” says Tešić.

What are prosecutors doing?

The microcredit foundation “Prizma” and the microcredit company “Singergija plus” fraudulently dragged thousands of citizens into credit indebtedness that they did not know existed. The workers of these organizations consciously chose citizens of predominantly poor means, pressed by poverty and problems in underdeveloped rural areas. They assured them that these were donations for these categories, and offered them smaller amounts of money. Months and even years later, they received lawsuits demanding the repayment of much larger amounts with interest. Small loans and borrowings that citizens took out were turned into huge amounts or were “pushed” into illegal reprograms in which they only added debts to them, without even seeing the extra money. Very often, it happened that the amount of reprogramming or interest far exceeded the original amount. This is confirmed by numerous verdicts against them, while the verdicts in several hundred individual and collective lawsuits filed on the same grounds are eagerly awaited. It is estimated that “Prizma” deceived at least 3,000 citizens in this way, and for “Sinergija plus” there is still no assessment of the situation.

Although these frauds were committed more than ten years ago, although hundreds of lawsuits have been filed, and in recent years there have been stories in public, it remains unclear why prosecutors are not engaged in investigating such a large fraud, but also why courts do not agree to consolidate victims’ lawsuits. It is encouraging that in the middle of last year, the courts began to rule in favour of the victims. In these verdicts, the first among dozens of lawsuits filed, it is stated that the request of “Eos Matrix” is unfounded and that the defendants will not have to settle the alleged debts, as well as that they must be paid court costs. These are just two examples of at least 3,000 citizens.

We asked several prosecutor’s offices in BiH whether and on what basis they investigated anything related to these two organizations or received any criminal charges against them, and whether they investigated the responsible persons.

“The Federal Prosecutor’s Office of the FBIH does not have data. The first-instance jurisdiction of the Supreme Court of the Federation of BiH has been revoked and it does not independently investigate or indict, but has the authority to represent cantonal prosecutor’s offices before the Supreme Court of the Federation of BiH on appeals against first-instance decisions of cantonal courts, as well as the competence in the procedure of repeating the criminal procedure as an extraordinary legal remedy “, they said.

However, the Banja Luka District Public Prosecutor’s Office had interesting information about these organizations. As they told us, PPO Banja Luka investigated several cases against registered workers in the Microcredit Organization “Prizma”, some of which ended with the indictment.

“On December 25, 2018, PPO Banja Luka filed an indictment against Dragan Balać from Šipovo, for abuse of official position or authority with a prolonged criminal offence of forging or destroying an official document and a prolonged criminal offence. An indictment was also filed against Radosava Savić, for abuse of official position or authority in connection with the extended criminal offence or destroying an official document. The indictment was confirmed on January 31, 2019, by the Basic Court in Mrkonjić Grad and court proceedings are underway. The Prosecutor’s Office filed an indictment against Goran Čikić on November 16, 2021, for abuse of official position or authority, and it was forwarded to the judge for a preliminary hearing of the Basic Court in Gradiška. There are three more cases related to the ‘Prizma’ Microcredit Organization. The cases were opened on the basis of criminal charges from citizens from the area covered by the Banja Luka District Public Prosecutor’s Office, which were damaged by the conclusion of harmful contracts. Also, the Prosecutor’s Office is acting in three cases against the registered legal entity ‘Eos matrix’ related to the criminal offence of persecution, “they said in the Public Prosecutor’s Office in Banja Luka.

The District Public Prosecutor’s Office in East Sarajevo has filed an indictment against Milenko Ponjarac, a former employee at “Prizma”, confirmed by the Basic Court in Sokolac.

So far, it has been determined that several investigations and criminal proceedings are being conducted against “Prizma” employees due to the conclusion of fictitious loan agreements. “Prizma” employees did not only cheat citizens on loans. As they themselves said, they also cheated those who really did have loans. Those who took out several thousand KM of credit and had problems with repayment were offered new loan agreements with larger amounts, in order to repay the original loans. It was a case of deception because someone who took out a loan of one thousand marks could still get that much interest, and according to the law, she cannot exceed the principal and make a debt of more than two thousand. However, officials would tell ignorant people that it is better to cover the old debt with a new loan of two thousand marks, and at the same time get extra time to secure money. Of course, then the interest could go twice as high, so they became indebted to 4,000 KM, when they were offered new contracts and the debt later grew to 8,000 KM, etc. Some even reached a debt of 20,000KM.

The worst thing is that the debtors, drawn into the vicious circle, became uncreditworthy, and then involved their family members or friends in everything, so that they could take out new loans and repay the old ones. Thanks to that, today we have young people aged 25 and 30 who are probably uncreditworthy for life.

They are fenced off from “Eos”

When the organization went bankrupt, the loans were kept in strict secrecy and it is unknown where they ended up. It is an open secret that “Prizma’s” funds were used to finance and buy votes, both in the RS and FBiH, just before the elections. Workers often complained about mobbing, especially those who worked outside the headquarters in Sarajevo.

The company “Eos matrix” said that they have nothing to do with possible controversial acts of “Prizma” employees and that all clients who feel cheated can contact them at any time.

However, when it comes to “Singergija plus”, the prosecution has no open cases in its work.

The Republic Public Prosecutor’s Office of Republika Srpska and its Special Department for the Suppression of Corruption, Organized and Serious Forms of Economic Crime have no reports or submissions that can be linked to the microcredit organizations “Prizma” and “Sinergija Plus”, nor reports against individuals related with these organizations.

It is also interesting that the trade in receivables has been persistently left in the so-called grey zone. The data show that banks and microcredit organizations got rid of bad loans worth over 950 million KM, selling them to lesser-known and almost mysterious agencies that no one controls.

The Central Bank of BiH does not have the authority to supervise the work of debt collection agencies and therefore does not have information on which legal provisions regulate the work of these agencies, it was announced earlier from this institution. The same is the case with the entity’s banking agencies. They also announced that the debt collection agencies have so far reported the purchase of banking and microcredits of business entities with a total value of 778,326,568 KM to the Central Credit Registry (CCR), with 47,336,391 KM of the remaining debt. Overdue uncollected principal amounts to 531,331,364 KM, while 161,039,126 KM is overdue uncollected interest. Loans to individuals are worth a total of 178,584,402 KM, with the remaining debt of 116,822,955 KM, overdue uncollected principal of 136,374,758 KM and overdue uncollected interest of 14,012,676 KM.

“Eos Matrix” also announced that they respect high standards in the treatment of debtors, which has brought them to the position of the most successful European company in this industry.

“Studious approach, professionals and technological solutions are the only way to bring results”, they stated and noted that they operate entirely within the legal framework of BiH, and that they are registered as a limited liability company, but that their activities are not prescribed special license as it exists in the financial sector. Consequently, there is no regulatory body to oversee them. They demand 216 million KM of bank and microcredits, of which 60 per cent is from citizens.

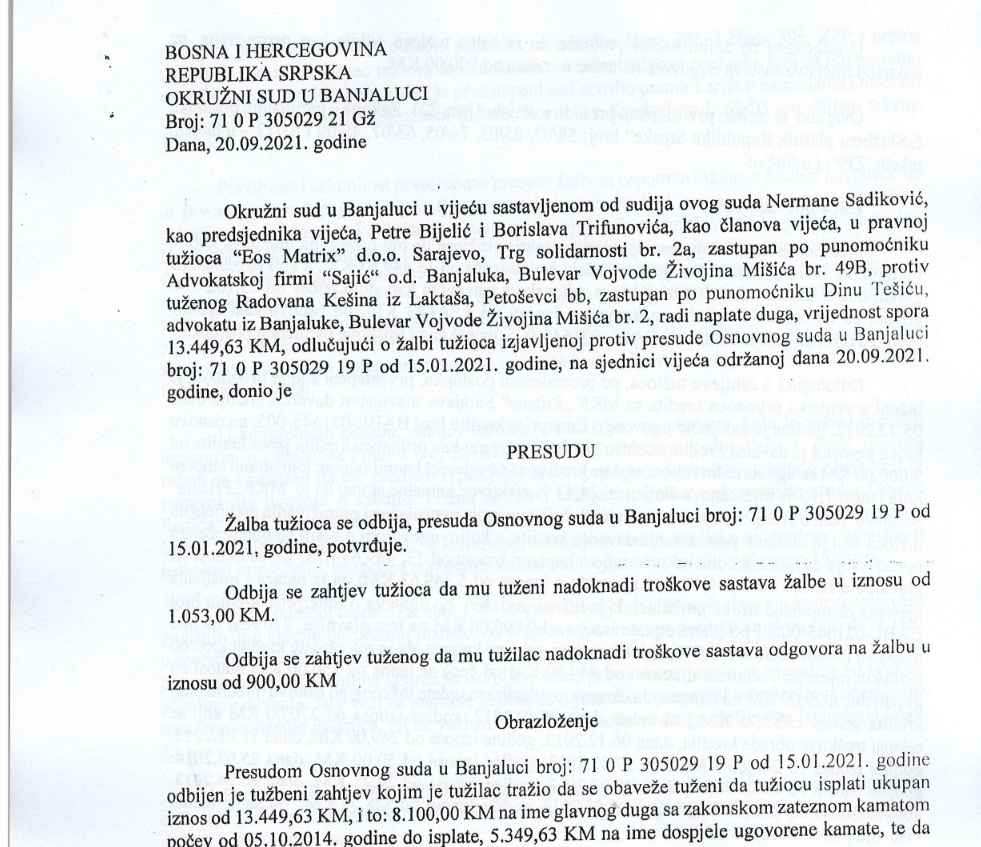

In October last year, two verdicts were passed in favour of the injured citizens, which “Prizma” illegally drew into loans and “Eos matrix” tried to collect certain amounts. The Basic Court in Banja Luka ruled in favour of Radovan Kešin and his wife Ljubljanka from Laktaši and acquitted them of a debt of almost 14,000 KM to “Eos”. The mentioned company will have to pay compensation for the costs of the procedure.

Almost at the same time, the same court ruled in favour of Stevo Boroja from Mrkonjić Grad, from whom “Eos matrix” demanded over 9.5 thousand KM.

ENG

ENG